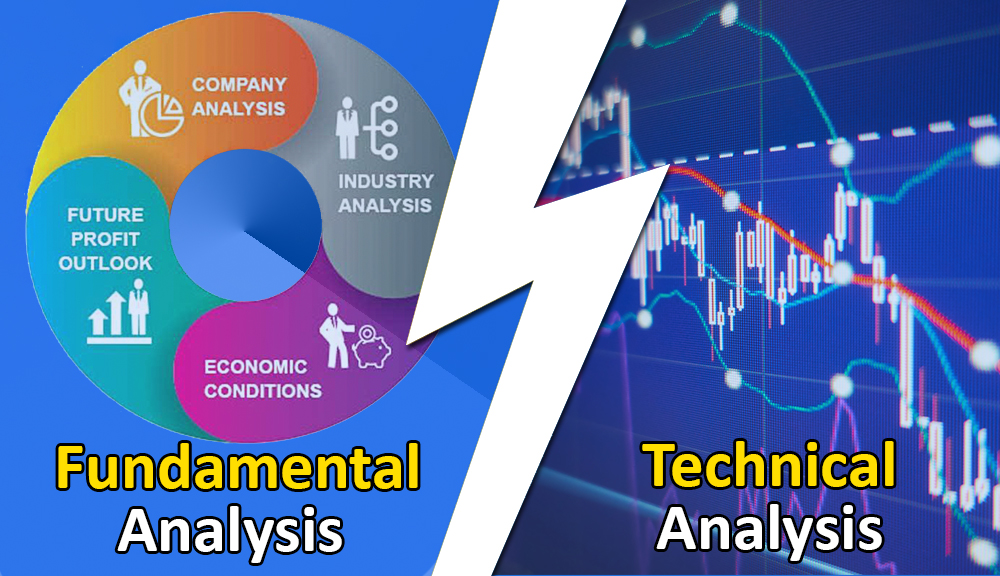

Two main ways exist in the realm of investment to examine markets and guide decisions: fundamental analysis and technical analysis. Everyone has their own set of ideas, instruments, and techniques. Investors in the forex, stock, commodity, and mutual fund markets sometimes find themselves arguing whose strategy performs best.

Knowing the variations and advantages of both will enable you to select the approach best for your objectives and investing style. Learn the Full Guide Today about Fundamental vs Technical Analysis From LIOCM.

Fundamental Analysis:

A Focus on Value: Whether it’s a currency, stock, commodity, or mutual fund, fundamental analysis holds that an asset’s value is determined by its underlying financial and economic circumstances. When studying a stock, for instance, fundamental analysts look at the company’s financial accounts including its income, earnings, and growth capacity. They also consider industry trends, economic data, and even worldwide elements that can affect the future performance of the stock. Fundamental study in forex markets usually concentrates on macroeconomic factors such as trade balances, inflation, unemployment, and interest rates.

Fundamental analysis for mutual funds is a study of the underlying asset performance of the fund and evaluation of the managerial team’s competence. Crucially important are things like the fund’s expense ratio, prior performance, and the general state of the market. Fundamental Analysis’s Benefits:

1. Long-Term Focus:

Long-term investors would find fundamental analysis most suitable. It provides investment possibilities based on inherent worth, thereby helping to uncover assets that might be underpriced or overpriced.

2. Holistic View:

By considering economic, industrial, and company-specific elements, this method offers a whole picture of the worth of an asset.

3. Risk Mitigation:

Understanding the underlying value lets basic analysis focus on wise investments with great growth potential, thereby helping to lower risk. Technical Analysis: Examination of Market Developments Conversely, technical study concentrates on market data and price charts to project future moves. Technical analysts focus on past data like price patterns, volume, and trends to forecast future movements; they feel that the price of an asset already reflects all pertinent information.

Technical analysis in forex trading uses moving averages, chart patterns including support and resistance levels, and oscillators such as the Relative Strength Index (RSI) to identify the ideal periods to buy or sell a currency pair. The presumption is that market activity is repetitious and that historical price movements can help one understand future price behavior.

Traders in stock markets frequently timing entrance and exit points using technical analysis. A breakout above a resistance level, for instance, would point to a buying opportunity; a slide below a support level would suggest a good time to sell. Technical analysis is also somewhat extensively applied in the commodity market. For example, especially in times of market volatility, gold dealers frequently base their decisions on technical indications and price patterns. Technical analysis is less important for mutual funds since most of them are long-term investments handled by experts.

Some investors, however, schedule their entrance and departures from the larger market or certain sectors using technical analysis. Technical Analysis’s Benefits. Short-Term Trading: Technical study is especially helpful for short-term traders trying to profit from price swings.

2. Timing the Market:

By using short-term trends, timing the market aids traders in pinpointing particular entrance and departure points, therefore optimizing returns. 3. Simple to Learn: Technical analysis is within reach of a wide spectrum of investors as, with the correct instruments, it can be easily applied. Which Approach—Fundamental or Technical—Works Best?

Your investment strategy and time horizon will determine the response mostly. Fundamental analysis provides a strong basis if you are a long-term investor trying to develop wealth over the years. It provides defense against market volatility by letting you invest in assets determined by their inherent value. But technical analysis might be more suited if you are a forex or commodity trader looking to profit from short-term price swings.

Without knowing the basic principles of the asset, it helps you time the market and profit on price swings. Regarding mutual funds, a combination of both strategies could be most effective. While technical research can help you timing your entrances and exits, fundamental analysis can help you select the correct funds depending on long-term performance.

Final Thought about Fundamental vs Technical Analysis:

Both basic and technical analysis have advantages; the “best” method relies on your objectives and investment horizon. While short-term traders want technical analysis, long-term investors typically go toward fundamental analysis. Many great investors mix technical analysis to maximize trade timing with fundamental analysis to choose assets. In the realm of forex, stocks, commodities, and mutual funds, a well-balanced approach that takes both approaches may present the best outcomes.